Xevaron Insights

Explore the latest trends and insights across various topics.

KYC Verification and Withdrawals: The Secret Dating Game of Your Cash

Unlock the secrets of KYC verification and withdrawals! Discover how they impact your cash flow in the dating game of finance.

Understanding KYC: A Key to Smooth Withdrawals

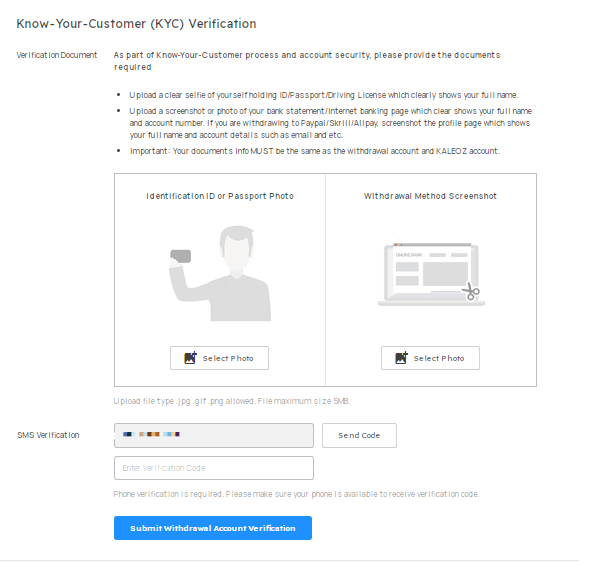

Understanding KYC (Know Your Customer) is an essential process for financial institutions and businesses, particularly in the realms of banking and cryptocurrency exchanges. It involves collecting and verifying customer information to prevent fraud, money laundering, and other illicit activities. By implementing KYC procedures, companies can ensure that they have a clear understanding of their clients' identities, allowing for smoother withdrawals and enhanced security. This process typically requires customers to submit identification documents, proof of address, and sometimes additional information depending on the service's regulatory requirements.

The benefits of a robust KYC process extend beyond compliance; they significantly improve the overall user experience. For instance, by ensuring that clients are properly verified, companies can expedite withdrawal processes, reducing the waiting time often associated with fund transfers. Furthermore, effective KYC practices foster trust between the client and the service provider, as customers feel more secure knowing that their funds are safeguarded. Ultimately, understanding and implementing a thorough KYC policy is a crucial step toward achieving smooth withdrawals and maintaining a reputable service within the financial ecosystem.

Unlock exclusive bonuses and promotions by using the rainbet promo code when signing up. Don’t miss out on the chance to enhance your betting experience with fantastic offers!

Top 5 Frequently Asked Questions About KYC Verification

Know Your Customer (KYC) verification is a crucial process employed by financial institutions to verify the identity of their clients. Here are the top 5 frequently asked questions about KYC verification:

- What is KYC verification? - KYC verification involves collecting personal information such as identification documents and proof of address to ensure that clients are who they claim to be.

- Why is KYC necessary? - KYC helps prevent money laundering, fraud, and other illicit activities, safeguarding both the institution and its clients.

- What documents are needed for KYC? - Typically required documents include a government-issued ID, proof of address, and sometimes financial statements.

- How long does KYC verification take? - The verification process can range from a few minutes to several days, depending on the institution and the complexity of the information provided.

- Is KYC verification reversible? - Once completed, KYC information is generally archived but can be updated or revised if client information changes.

Why KYC Compliance is Crucial for Secure Cash Withdrawals

KYC compliance plays a pivotal role in ensuring secure cash withdrawals, primarily by preventing fraud and money laundering activities. Financial institutions are required to adhere to strict regulations that mandate them to verify the identity of their clients. This process entails collecting essential information such as government-issued identification, proof of address, and potentially other supporting documents. By implementing KYC protocols, banks and other financial platforms can mitigate risks associated with illicit activities, thereby fostering a safer environment for all users.

Moreover, effective KYC compliance enhances customer trust and confidence in financial services. When clients are assured that their personal information is managed securely and that the institution is committed to adhering to regulatory requirements, they are more likely to engage in transactions with peace of mind. Ultimately, this fosters a culture of accountability and transparency within the financial sector, reinforcing the necessity of KYC compliance not just for regulatory reasons, but as a fundamental component of a secure financial ecosystem.