Xevaron Insights

Explore the latest trends and insights across various topics.

Withdrawal Wizardry: Navigating Methods and Fees Like a Pro

Master withdrawal fees and methods effortlessly! Unlock insider tips and save money with our expert guide to withdrawal wizardry.

Understanding Withdrawal Methods: A Comprehensive Guide for Your Transactions

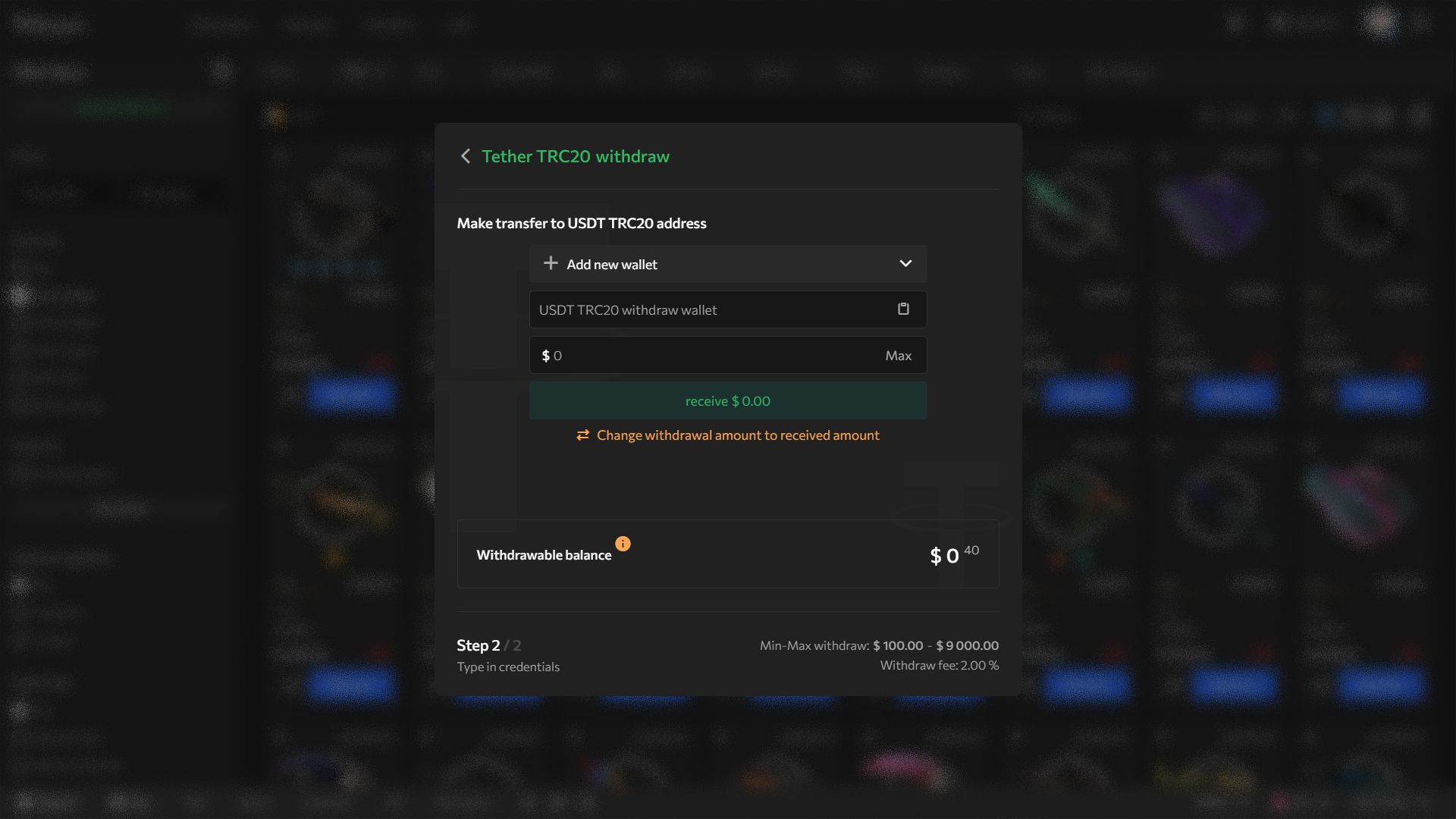

When it comes to managing your online transactions, understanding withdrawal methods is crucial. Different platforms offer various options for withdrawing funds, including bank transfers, e-wallet services, and cryptocurrency withdrawals. Each method comes with its own set of advantages and disadvantages, such as processing times, fees, and accessibility, which can influence your overall experience. Consider the following factors when choosing a withdrawal method:

- Speed: Some methods process transactions almost instantly, while others may take several business days.

- Fees: Withdrawal fees can vary significantly between methods, impacting your total withdrawal amount.

- Security: Ensure the method you choose offers robust security features to protect your funds.

In addition to the factors mentioned above, it's essential to be aware of any minimum or maximum withdrawal limits associated with each method. Some platforms impose restrictions on the amount you can withdraw at once, which may affect your financial planning. Furthermore, understanding withdrawal methods can help you maintain a smooth transaction process, avoiding unnecessary delays. By being informed and selecting the most suitable method for your needs, you can enhance your online financial management experience and ensure that your transactions are both efficient and secure.

Take advantage of our special duel promo code to get exclusive discounts and offers when you sign up. Don't miss out on the opportunity to save on your next purchase!

What Are the Hidden Fees? Demystifying Withdrawal Costs Across Platforms

When navigating the world of online platforms for trading or investing, hidden fees can greatly impact your overall returns. Many users find themselves surprised at the cost of withdrawing funds, which can vary significantly across platforms. To better understand these withdrawal costs, it’s crucial to examine how different platforms structure their fees. For instance, some platforms may charge a flat fee per withdrawal, while others implement a percentage-based model that scales with the amount withdrawn. Always read the fine print and make comparisons to ensure that you are not facing unexpected costs when you attempt to access your funds.

Moreover, hidden fees can also include maintenance charges, currency conversion fees, and even transaction fees that some platforms impose. It’s important to remember that these withdrawal costs can erode your profits if you're not careful. To help users make more informed decisions, consider creating a personal checklist of platforms and their associated withdrawal fees. This approach will demystify the process and allow you to select the best service that aligns with your financial goals.

How to Choose the Best Withdrawal Method for Your Needs: Tips and Tricks

Choosing the best withdrawal method for your needs is crucial for ensuring a smooth transaction experience. With so many options available, it's essential to consider factors such as fees, processing times, and security. Start by assessing your personal preferences and requirements. For instance, if you prioritize speed, you might opt for e-wallets or instant transfer options. If you're concerned about security, consider methods that provide added encryption or are backed by reputable financial institutions.

Once you've narrowed down your choices, compare the specific withdrawal methods against each other. Here are some tips to help you decide:

- Fees: Be aware of any charges associated with withdrawals.

- Availability: Ensure that your chosen method is accepted by your platform.

- Customer Support: Look for options that offer reliable customer service in case you encounter issues.

- Personal Comfort: Choose a method you are familiar and comfortable with.

By following these tips, you can confidently select the withdrawal method that aligns best with your needs.